All Categories

Featured

Table of Contents

The payments that would certainly have or else gone to a banking institution are paid back to your individual pool that would certainly have been utilized. More cash goes into your system, and each buck is performing multiple tasks.

This cash can be utilized tax-free. You have full accessibility to your funds whenever and for whatever you want, without fees, charges, testimonial boards, or extra security. The cash you use can be paid back at your leisure with no collection repayment routine. And, when the moment comes, you can hand down whatever you have actually developed to those you like and appreciate completely.

This is exactly how households hand down systems of wealth that make it possible for the next generation to follow their desires, start organizations, and benefit from possibilities without losing it all to estate and inheritance tax obligations. Companies and financial institutions use this technique to produce working pools of capital for their businesses.

What resources do I need to succeed with Financial Leverage With Infinite Banking?

Walt Disney utilized this technique to begin his imagine building a style park for children. We 'd enjoy to share extra examples. The concern is, what do want? Assurance? Financial safety and security? A sound financial option that doesn't rely upon a rising and fall market? To have money for emergency situations and possibilities? To have something to pass on to individuals you enjoy? Are you going to find out even more? Financial Preparation Has Failed.

Sign up with among our webinars, or participate in an IBC boot camp, all cost free. At no charge to you, we will instruct you much more about exactly how IBC works, and create with you a strategy that works to address your trouble. There is no obligation at any kind of factor while doing so.

This is life. This is tradition (Private banking strategies). Call among our IBC Coaches right away so we can reveal you the power of IBC and whole life insurance policy today. ( 888) 439-0777.

It feels like the name of this principle modifications as soon as a month. You might have heard it referred to as a perpetual riches method, household banking, or circle of riches. No matter what name it's called, unlimited financial is pitched as a secret method to build wide range that only abundant people know about.

What resources do I need to succeed with Cash Flow Banking?

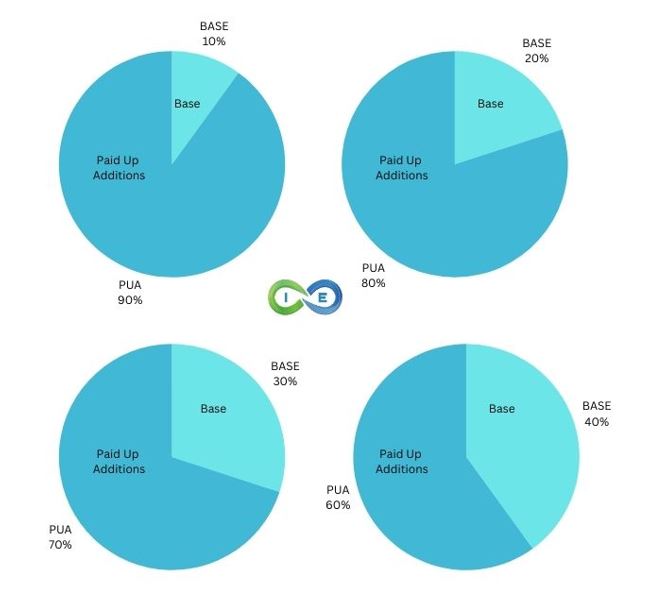

You, the insurance policy holder, put cash into a whole life insurance policy policy with paying costs and buying paid-up enhancements. This boosts the cash money worth of the plan, which suggests there is even more cash money for the returns price to be put on, which normally implies a higher rate of return in general. Dividend prices at significant providers are currently around 5% to 6%.

The whole idea of "banking on yourself" just functions because you can "bank" on yourself by taking lendings from the plan (the arrowhead in the graph over going from whole life insurance policy back to the insurance policy holder). There are 2 different kinds of finances the insurance provider may offer, either straight acknowledgment or non-direct recognition.

One function called "wash loans" sets the rate of interest price on fundings to the same price as the reward rate. This suggests you can obtain from the plan without paying passion or receiving passion on the quantity you borrow. The draw of boundless financial is a returns passion rate and ensured minimal price of return.

The disadvantages of boundless financial are typically ignored or otherwise stated in all (much of the info readily available about this idea is from insurance policy agents, which may be a little prejudiced). Only the cash money value is growing at the reward price. You likewise need to pay for the cost of insurance, charges, and expenses.

How does Tax-free Income With Infinite Banking compare to traditional investment strategies?

Every irreversible life insurance policy is different, but it's clear someone's overall return on every buck spent on an insurance policy product could not be anywhere close to the reward price for the plan.

To give an extremely fundamental and theoretical example, let's assume someone is able to make 3%, on average, for every single dollar they invest in an "infinite financial" insurance coverage product (after all expenditures and charges). This is double the approximated return of whole life insurance policy from Customer Information of 1.5%. If we presume those dollars would certainly go through 50% in taxes amount to otherwise in the insurance coverage product, the tax-adjusted rate of return can be 4.5%.

We presume greater than average returns on the whole life item and a really high tax obligation rate on dollars not put right into the policy (which makes the insurance policy product look much better). The reality for several individuals may be worse. This pales in comparison to the long-lasting return of the S&P 500 of over 10%.

How do I leverage Cash Flow Banking to grow my wealth?

Infinite banking is an excellent product for representatives that market insurance policy, but may not be optimal when contrasted to the less costly choices (without any sales individuals earning fat commissions). Below's a malfunction of several of the various other purported advantages of unlimited banking and why they may not be all they're gone crazy to be.

At the end of the day you are getting an insurance item. We enjoy the defense that insurance policy uses, which can be gotten much less expensively from a low-priced term life insurance policy. Overdue lendings from the plan may additionally minimize your death advantage, diminishing another degree of defense in the plan.

The principle only works when you not just pay the significant costs, but use extra cash money to purchase paid-up additions. The chance cost of every one of those dollars is remarkable extremely so when you could instead be purchasing a Roth IRA, HSA, or 401(k). Also when contrasted to a taxable investment account or perhaps a financial savings account, unlimited banking may not use equivalent returns (compared to investing) and similar liquidity, accessibility, and low/no cost framework (contrasted to a high-yield interest-bearing accounts).

Lots of individuals have never ever listened to of Infinite Banking. Infinite Banking is a method to manage your money in which you develop a personal bank that works simply like a normal financial institution. What does that indicate?

Is there a way to automate Financial Leverage With Infinite Banking transactions?

And thanks to the money value cost savings portion of your entire life insurance policy plan, you're able to take plan financings that will not interfere with the development of your cash. Infinite Banking for financial freedom. As a result, you can finance anything you require and want, i.e.,. Basically, you're doing the financial, yet instead of relying on the typical financial institution, you have your own system and complete control.

Infinite Banking isn't called by doing this without a reasonwe have unlimited means of implementing this procedure right into our lives in order to absolutely own our lifestyle. So, in today's short article, we'll show you 4 different methods to use Infinite Banking in organization. We'll talk about six methods you can use Infinite Banking directly.

Table of Contents

Latest Posts

How do I leverage Generational Wealth With Infinite Banking to grow my wealth?

How do I track my growth with Infinite Banking Vs Traditional Banking?

Infinite Banking For Retirement

More

Latest Posts

How do I leverage Generational Wealth With Infinite Banking to grow my wealth?

How do I track my growth with Infinite Banking Vs Traditional Banking?

Infinite Banking For Retirement