All Categories

Featured

Table of Contents

- – Is there a way to automate Cash Value Leveragi...

- – What resources do I need to succeed with Infin...

- – What are the most successful uses of Financia...

- – Can I use Infinite Banking Benefits to fund l...

- – Is Borrowing Against Cash Value a good strat...

- – How do I optimize my cash flow with Life Ins...

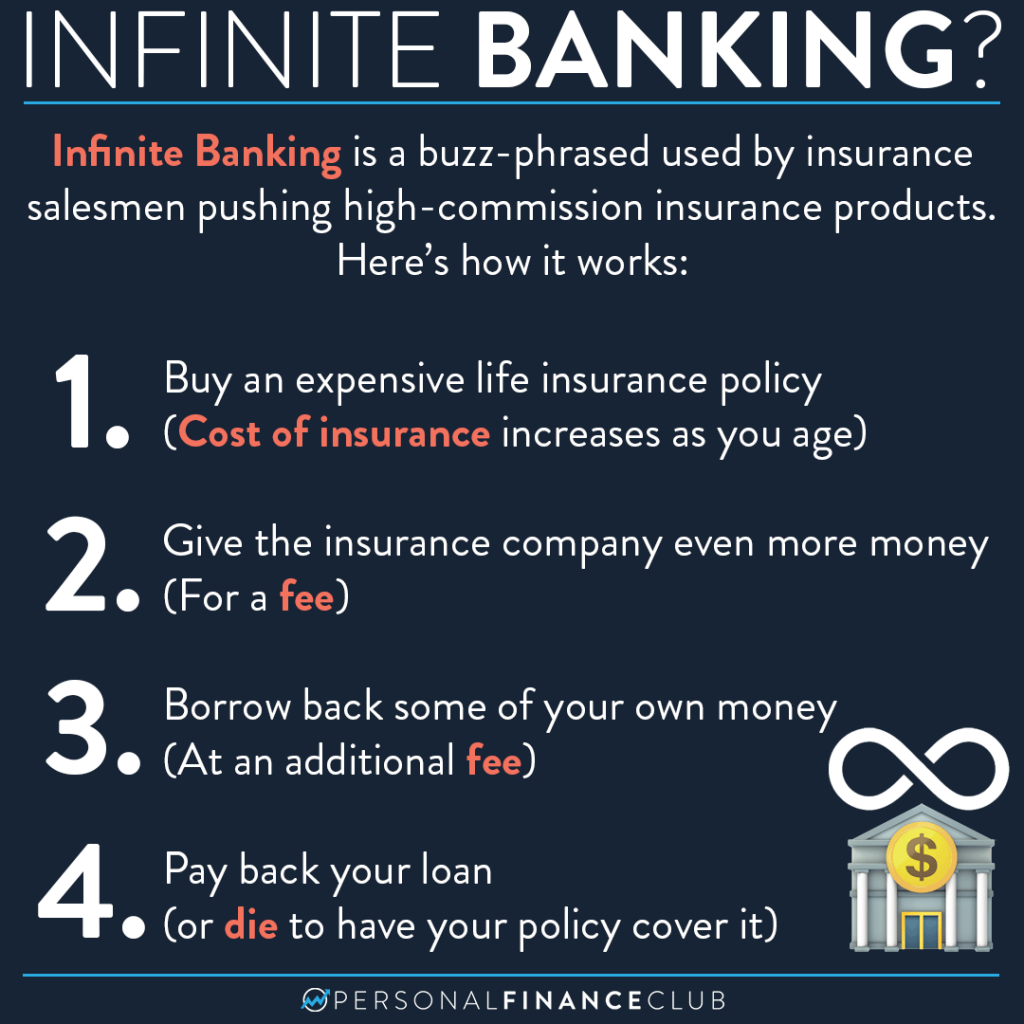

We use data-driven techniques to assess monetary items and services - our evaluations and scores are not influenced by advertisers. Limitless financial has captured the passion of lots of in the personal finance world, guaranteeing a path to financial freedom and control.

Unlimited banking refers to a financial technique where a private becomes their very own banker. The policyholder can borrow versus this cash worth for numerous financial needs, effectively loaning money to themselves and repaying the plan on their own terms.

This overfunding speeds up the growth of the plan's money worth. The insurance holder can after that obtain against this money worth for any purpose, from financing an automobile to purchasing property, and after that pay off the funding according to their own timetable. Unlimited financial offers numerous advantages. Right here's a look at a few of them. Infinite Banking.

Is there a way to automate Cash Value Leveraging transactions?

Right here are the solution to some questions you could have. Is boundless financial legitimate? Yes, unlimited financial is a legit strategy. It entails making use of a whole life insurance policy policy to create an individual funding system. Its efficiency depends on numerous factors, including the policy's structure, the insurance policy firm's performance and exactly how well the technique is handled.

It can take a number of years, often 5-10 years or more, for the money value of the policy to expand sufficiently to start obtaining versus it efficiently. This timeline can differ depending on the plan's terms, the costs paid and the insurance coverage firm's efficiency.

What resources do I need to succeed with Infinite Wealth Strategy?

So long as premiums are present, the insurance holder simply calls the insurance firm and requests a funding versus their equity. The insurer on the phone will not ask what the car loan will certainly be used for, what the earnings of the borrower (i.e. insurance policy holder) is, what other properties the person could need to function as collateral, or in what timeframe the person means to pay back the loan.

In comparison to term life insurance policy items, which cover only the recipients of the insurance holder in the event of their death, entire life insurance policy covers a person's whole life. When structured properly, whole life policies generate a distinct income stream that raises the equity in the plan over time. For more analysis on how this works (and on the benefits and drawbacks of entire life vs.

In today's world, one driven by benefit of consumption, also numerous take for approved our nation's purest starting principles: freedom and justice. Lots of people never ever think just how the products of their bank fit in with these merits. So, we position the easy concern, "Do you really feel liberated or warranted by operating within the restraints of industrial credit lines?" Click on this link if you want to locate a Licensed IBC Practitioner in your area.

What are the most successful uses of Financial Independence Through Infinite Banking?

It is an idea that allows the insurance policy holder to take lendings on the whole life insurance coverage policy. It needs to be offered when there is a minute economic concern on the person, wherein such loans might aid them cover the economic load.

Such abandonment value functions as cash money security for a funding. The policyholder requires to get in touch with the insurer to ask for a finance on the policy. A Whole Life insurance policy plan can be labelled the insurance policy product that supplies defense or covers the individual's life. In the occasion of the possible death of the individual, it supplies financial security to their household participants.

The policy may require month-to-month, quarterly, or annual repayments. It begins when an individual uses up a Whole Life insurance policy. Such plans might buy company bonds and federal government safeties. Such policies maintain their values as a result of their conservative method, and such plans never purchase market instruments. For that reason, Infinite banking is an idea that enables the insurance holder to take up fundings overall life insurance coverage policy.

Can I use Infinite Banking Benefits to fund large purchases?

The money or the surrender value of the entire life insurance policy acts as collateral whenever taken lendings. Suppose a specific enrolls for a Whole Life insurance policy policy with a premium-paying term of 7 years and a policy period of two decades. The specific took the policy when he was 34 years of ages.

The collateral obtains from the wholesale insurance plan's cash or surrender worth. These elements on either extreme of the spectrum of truths are reviewed listed below: Infinite financial as a monetary development improves money flow or the liquidity profile of the policyholder.

Is Borrowing Against Cash Value a good strategy for generational wealth?

In monetary situations and difficulties, one can make use of such products to get car loans, therefore minimizing the trouble. It provides the lowest financing cost contrasted with the standard loan product. The insurance plan loan can also be offered when the person is out of work or encountering wellness problems. The entire Life insurance policy plan retains its general worth, and its performance does not link with market performance.

In enhancement, one need to take only such plans when one is financially well off and can handle the policies premiums. Boundless financial is not a fraud, however it is the finest thing a lot of individuals can opt for to improve their monetary lives.

How do I optimize my cash flow with Life Insurance Loans?

When people have limitless banking described to them for the initial time it feels like a wonderful and safe method to expand wealth - Infinite Banking account setup. The idea of replacing the hated financial institution with borrowing from on your own makes so much more feeling. However it does require replacing the "despised" bank for the "hated" insurance company.

Obviously insurance firms and their agents enjoy the idea. They developed the sales pitch to sell more entire life insurance policy. However does the sales pitch live up to genuine world experience? In this post we will initially "do the math" on limitless banking, the financial institution with yourself viewpoint. Because fans of unlimited financial might claim I'm being prejudiced, I will certainly make use of screen shots from a supporter's video and link the entire video clip at the end of this post.

There are two severe monetary calamities developed into the boundless banking principle. I will certainly subject these problems as we function via the mathematics of exactly how boundless financial actually works and how you can do a lot far better.

Table of Contents

- – Is there a way to automate Cash Value Leveragi...

- – What resources do I need to succeed with Infin...

- – What are the most successful uses of Financia...

- – Can I use Infinite Banking Benefits to fund l...

- – Is Borrowing Against Cash Value a good strat...

- – How do I optimize my cash flow with Life Ins...

Latest Posts

Unlimited Banking Solutions

Infinity Banking

How To Take Control Of Your Finances And Be Your Own ...

More

Latest Posts

Unlimited Banking Solutions

Infinity Banking

How To Take Control Of Your Finances And Be Your Own ...